Expensify does best when paired with accounting software. In other words, while you can use the app to track mileage and send invoices, both features are fairly basic. However, Expensify isn’t an all-in-one online accounting solution-it’s a targeted expense-tracking app with some bookkeeping and budgeting features.

Nch express accounts track milage free#

Most crucially, its free plan for corporations includes free corporate card management via the Expensify Card, which everyone on your team can use for free. It excels at scanning and categorizing receipts, generating reports for tax time, and managing employee expense reimbursements. (The free plan limits you to just one.)Įxpensify is first and foremost an expense-management program.

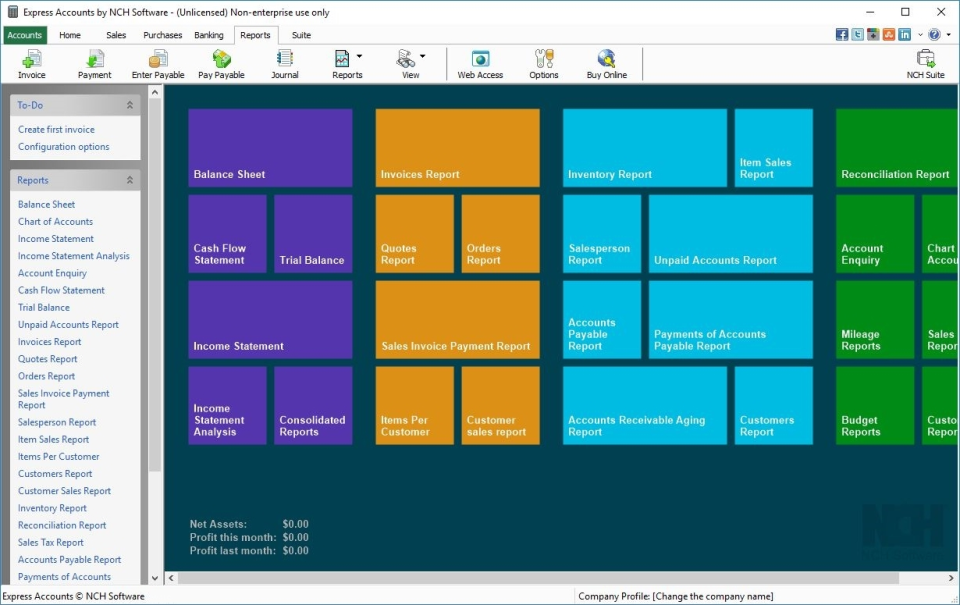

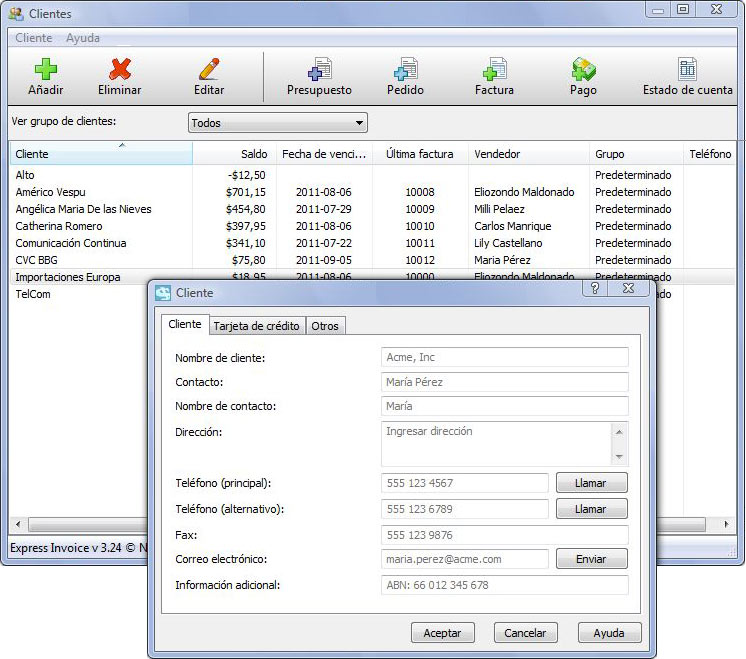

If you like ZipBooks' user-friendly interface but want more features, its paid plans start at $15 a month and allow for five users. And while ZipBooks' free plan includes just two business financial statements, they're the most important ones (the profit and loss statement and balance sheet)-you won't be overwhelmed by too many complex reports, but you'll still get the basic information you need to make wise investment choices as you grow your business. Its chart of accounts is straightforward and user-friendly, which is crucial for first-time business owners with limited financial knowledge. But what few things ZipBooks does, it does quite well. We know, we know-that doesn't look like much, especially when compared to Wave and Zoho Invoice.

Nch express accounts track milage software#

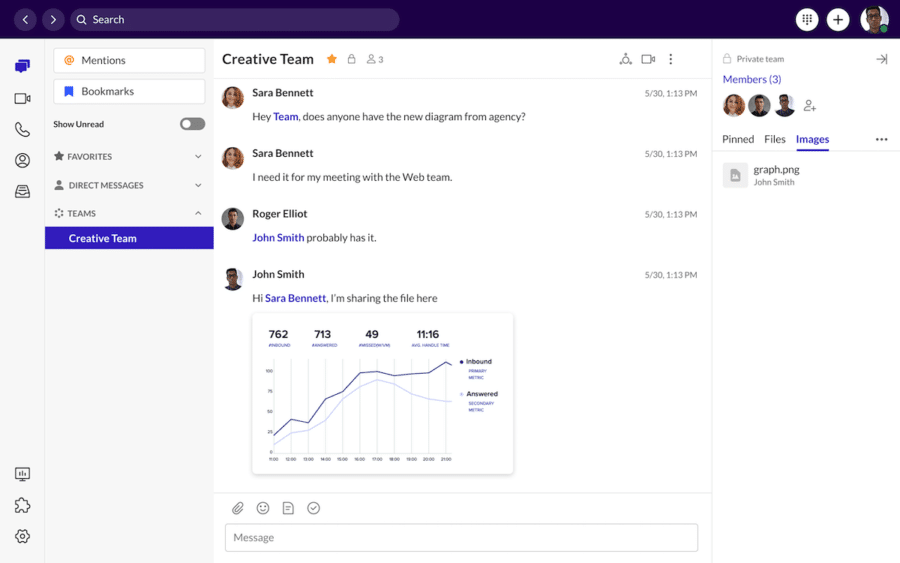

This software does much more than send invoices (though you shouldn't overlook its stellar invoicing features-Zoho Invoice is actually our top pick for billing and invoicing software). You and the rest of your financial team can jump on your account to check numbers and enter information, free of charge.ĭon't be fooled by Zoho Invoice's name. Its billing, invoicing, and expense tracking features make it perfect for freelancers, but the software can work for larger businesses too, especially since Wave doesn’t limit the amount of users you can add (unlike, say, QuickBooks Online). Wave’s easy-to-read dashboard shows you your most important financial info at a glance. Automatically generated journal entries.Crucial accounting reports and general ledger.Easy, customizable income and expense tracking.Unlimited bank account and credit card connections.Automatic bank account and credit card syncing for accurate, up-to-date financial records.It’s one of our top accounting software picks for small-business owners, and for good reason.

Even if Wave weren’t completely free, we’d still be blown away by how much it offers.

0 kommentar(er)

0 kommentar(er)